How to Defend Your Declared Value During a CBP Audit

When U.S. Customs and Border Protection (CBP) initiates a post-entry audit, one of the first areas they examine is the declared customs value of imported goods. Errors or inconsistencies in declared value can lead to costly penalties, duty adjustments, and even allegations of negligence.

Knowing how to defend your declared value is essential for maintaining compliance and protecting your company’s financial integrity.

Understanding Declared Value

The declared value represents the price used to determine the amount of duty owed on imported merchandise. Under U.S. law (19 U.S.C. §1401a), the primary method for valuation is the transaction value, defined as the price actually paid or payable for goods when sold for export to the United States.

However, CBP expects importers to demonstrate that their declared values are accurate, supported by documentation, and comply with all valuation rules.

Failure to do so can trigger further scrutiny, fines, or reassessments.

Common Triggers for CBP Valuation Audits

CBP often selects importers for valuation audits when it detects patterns such as:

- Large price fluctuations between related-party transactions

- Undeclared assists like design services or tooling provided to suppliers

- Inconsistent invoice or purchase order values

- Transfer pricing adjustments that affect customs value

- Missing documentation or unsupported declared prices

When these red flags appear, CBP may request detailed records to confirm how the importer calculated and documented the declared value.

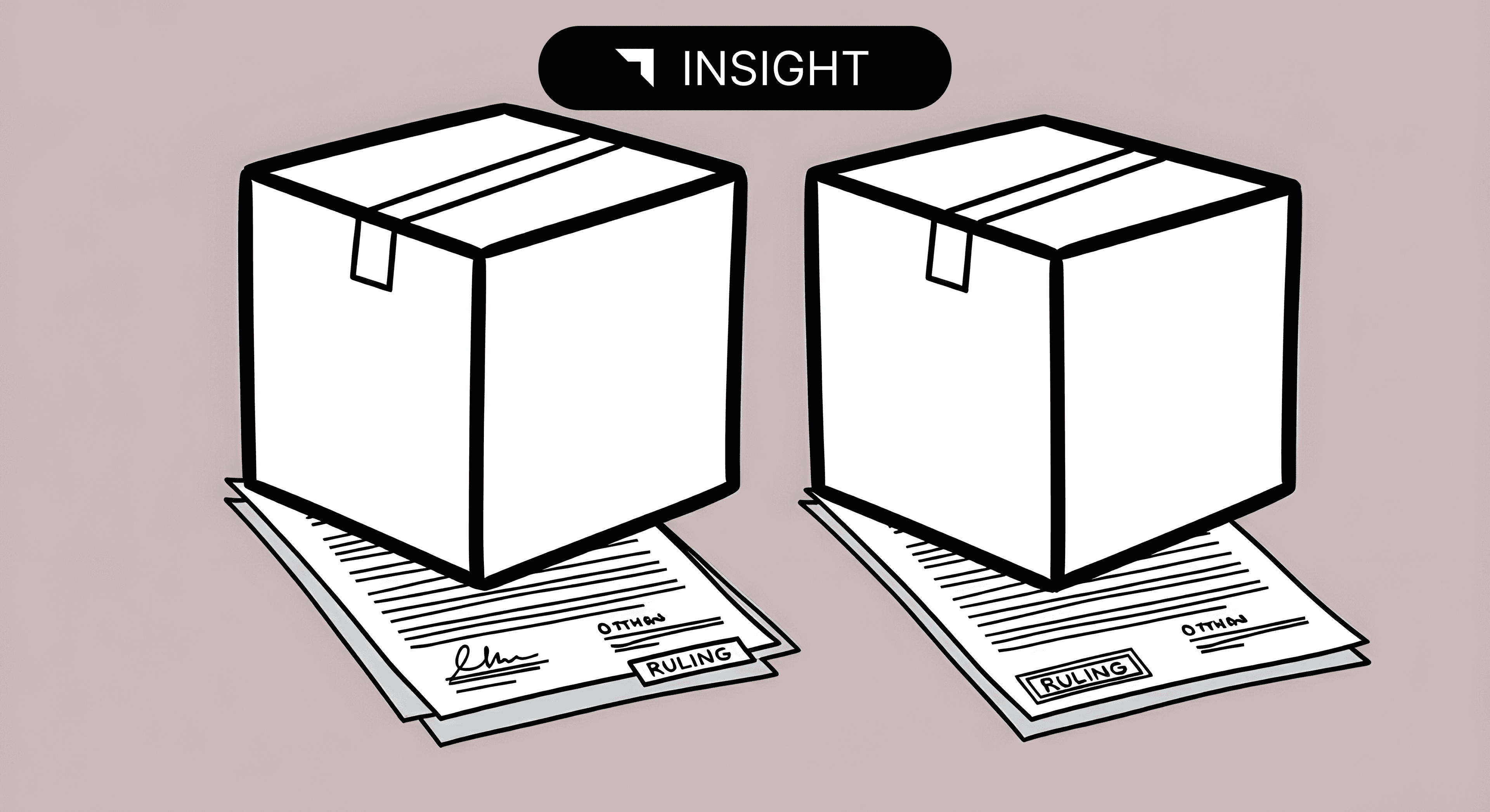

Key Documentation to Support Your Declared Value

A defensible declared value depends on a complete and organized valuation file.

Importers should be prepared to produce the following records during an audit:

| Documentation Type | Purpose | Example |

|---|---|---|

| Commercial Invoices | Show the price paid for the goods | Supplier invoice for each shipment |

| Purchase Orders | Confirm buyer–seller terms | Signed PO with unit prices and Incoterms |

| Proof of Payment | Validate that the declared price was actually paid | Bank wire confirmations, payment receipts |

| Transfer Pricing Studies | Support related-party pricing fairness | IRS documentation or benchmarking reports |

| Assists & Additions Records | Reveal any additional value that must be included | Engineering designs, molds, or royalties |

| Contracts or Agreements | Define price terms and adjustments | Long-term supply or distribution agreements |

Maintaining these records in a centralized, searchable audit trail helps importers respond quickly and confidently during CBP requests.

Strategies to Defend Declared Value During a CBP Audit

-

Document Your Valuation Methodology

Explain clearly how you arrived at your declared value and which valuation method you used (transaction value, computed value, deductive value, or fallback). -

Align Customs and Transfer Pricing Policies

CBP focuses on whether related-party transactions are at arm’s length. Ensure your customs valuation and transfer pricing documentation are consistent. -

Conduct Internal Valuation Reviews

Periodically review declared values and underlying records to confirm compliance with 19 CFR Part 152. -

Track Additions and Deductions Accurately

Include dutiable additions (assists, royalties, commissions) and exclude nondutiable costs properly (domestic freight, U.S. duties). -

Respond Quickly and Transparently to CBP

When CBP issues a request for information (CF-28) or a Notice of Action (CF-29), provide detailed documentation and professional explanations within the deadlines. -

Leverage Technology for Audit Readiness

Modern compliance platforms like Trade Insight AI allow importers to maintain classification, valuation, and audit data in structured, retrievable formats—making audit defense faster and more reliable.

Common Mistakes to Avoid

- Submitting incomplete documentation or late responses

- Assuming transfer pricing automatically satisfies customs valuation rules

- Ignoring assists or royalties in declared value calculations

- Failing to document why alternate valuation methods were used

- Overlooking currency conversions and Incoterm adjustments

Proactive internal controls can prevent these errors from escalating into audit findings.

Building a Sustainable Valuation Compliance Program

Defending your declared value is easier when compliance is built into daily operations.

Importers should:

- Establish clear SOPs for valuation and documentation

- Train procurement and finance teams on customs valuation principles

- Use automated audit trails to log valuation logic, adjustments, and approvals

- Review high-risk supplier relationships regularly

This ongoing vigilance demonstrates reasonable care and positions your company for successful audit outcomes.

Final Thoughts

A CBP audit does not have to be a crisis. With the right documentation, consistent valuation practices, and strong internal controls, your declared value can withstand scrutiny and reinforce your company’s reputation for compliance integrity.

Want to make your customs valuation process audit-proof?

Explore Trade Insight AI for tools that help compliance teams maintain defensible valuation data and respond confidently during CBP reviews.

Related News

December 10, 2025

How to Build an Audit Ready Memo Using CROSS and GRI Together

Read more →

November 5, 2025

Export Snapshot: Bahrain – What U.S. Exporters Need to Know About the U.S.–Bahrain Free Trade Agreement (USBFTA)

Read more →

February 19, 2026